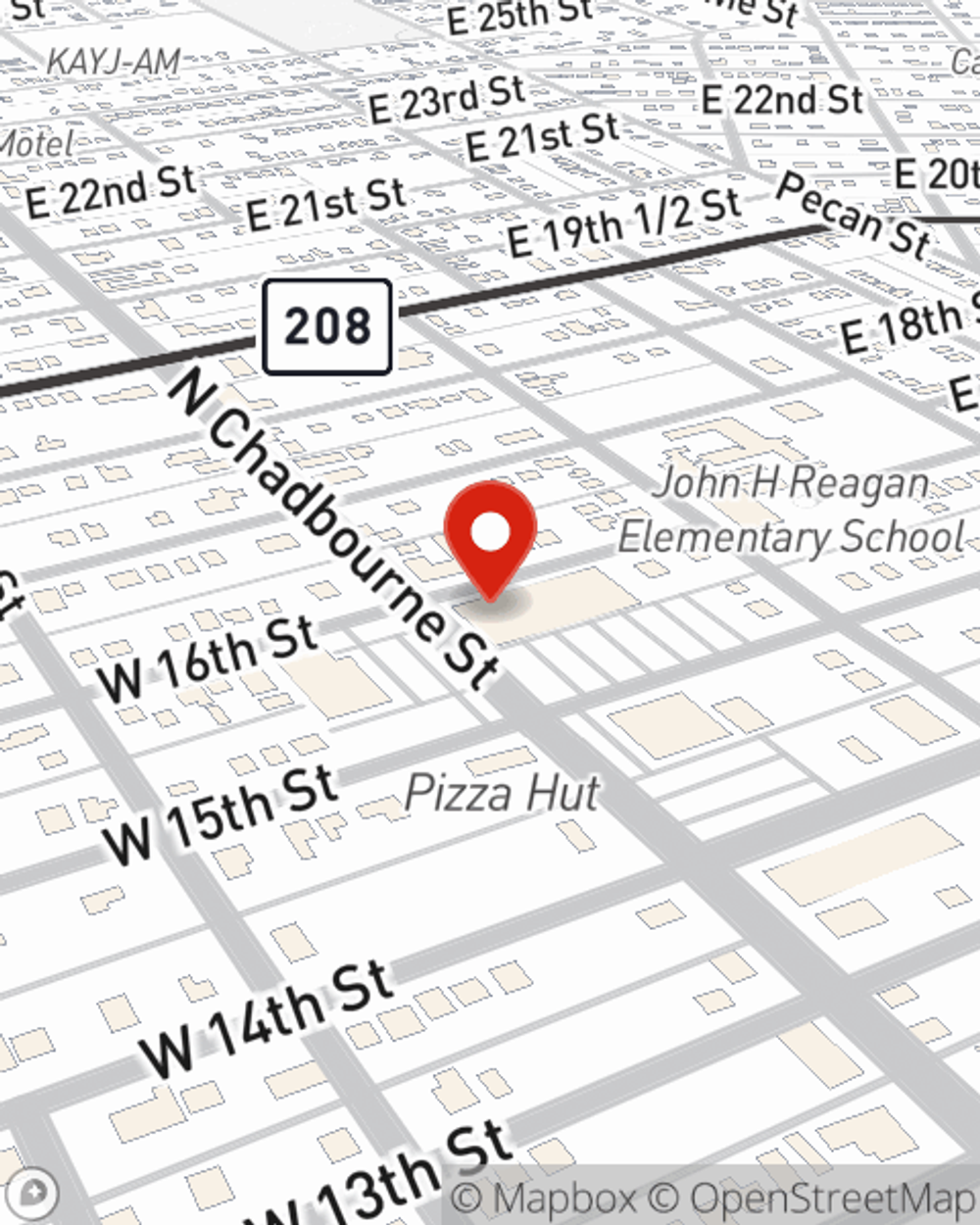

Business Insurance in and around San Angelo

One of San Angelo’s top choices for small business insurance.

No funny business here

Help Protect Your Business With State Farm.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide terrific insurance for your business. Your policy can include options such as errors and omissions liability, worker's compensation for your employees, and a surety or fidelity bond.

One of San Angelo’s top choices for small business insurance.

No funny business here

Get Down To Business With State Farm

Whether you own an art gallery, an antique store or a farm supply store, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Benjamin Villarreal is here to talk through your business insurance options with you. Call or email Benjamin Villarreal today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Benjamin Villarreal

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.